How Patience and Quality Intertwine

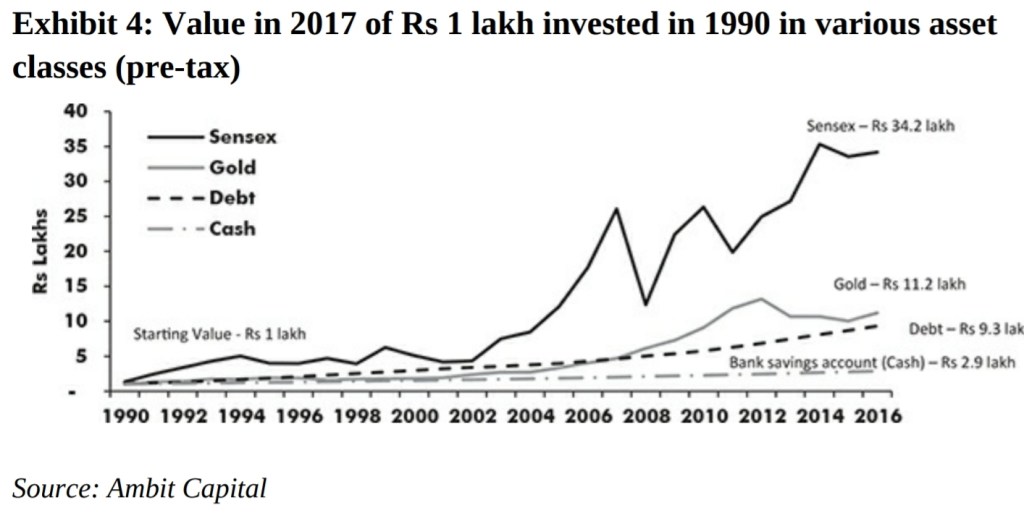

Over the past 41 years BSE SENSEX has give CAGR of 16.37% with base value of 100 in the year 1979 and now at 50136.58 in the year 2021. This return is more than higher of CPI and Risk Free Rate.

So why does an Investor lose money in Equity markets?

They are loss aversion, investor dislikes losses of 2-2.5% than gains. The probability of generating positive returns increases with the holding period for BSE Sensex. Investors who do not have even a year of patience are likely to believe that Equity markets have higher risk than return. Short term investors frequently update or rebalance their portfolio are more likely to suffer losses than gains.

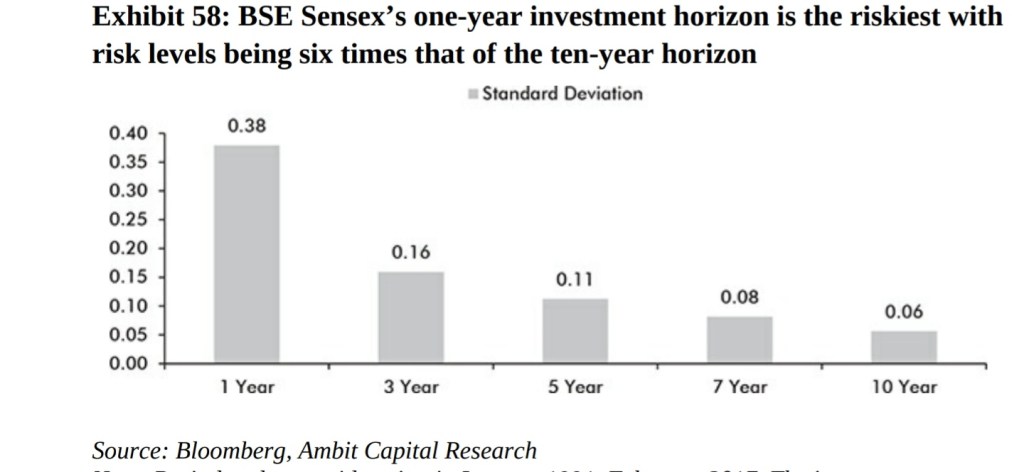

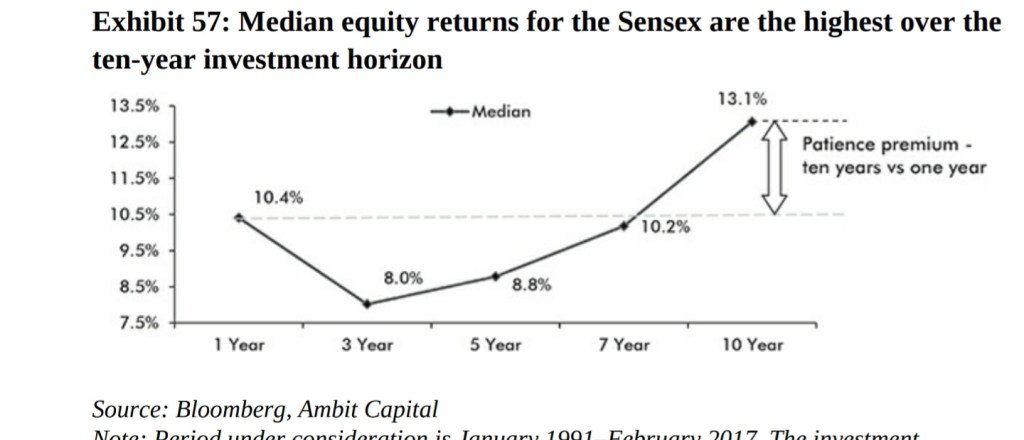

Patience premium is the difference between return of a stock and index over holding period. A positive value of ‘patience premium’ implies that the longer the holding period of a stock, the higher is the return generated from it for an investor. As the holding period increases, the risk i.e Standard Deviation decreases. The one-year investment horizon has the widest range of equity returns, from a peak of 256 per cent delivered over April 1991 to April 1992 to a trough of -56 per cent delivered over December 2007 to December 2008. The one-year investment horizon can be an intense roller-coaster ride. The degree of risk involved in a one-year holding period has been 3-4x higher than the risk involved in a five-year holding period and 6x higher than the risk involved in a ten-year holding period.

If one would have just invested RS.25k at initiation in BSE SENSEX and have not done any changes would be worth of RS.12.5 millions after 41 years with CAGR of 16.37%. This how the patience premium is earned.

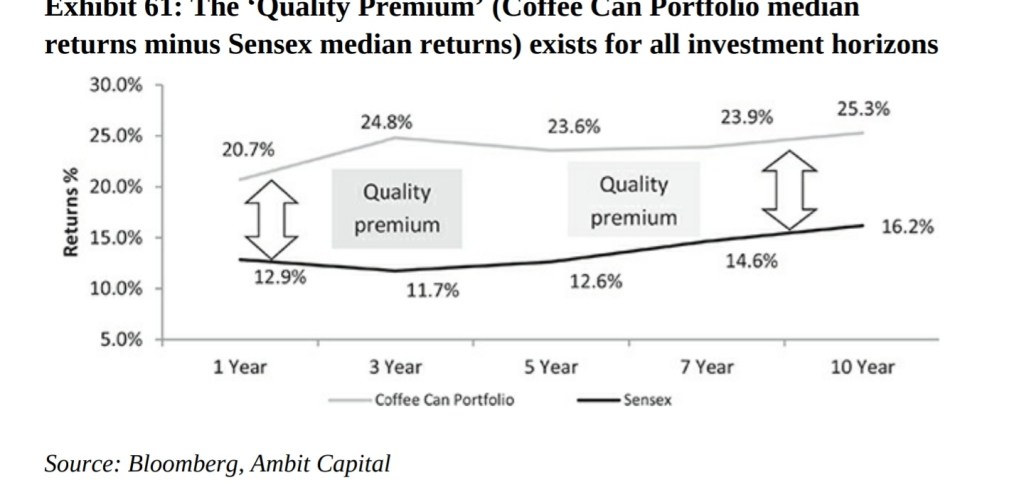

Quality premium is the difference between the annualized returns generated by a stock or a portfolio of stocks and the benchmark index over holding period. If the premium if positive it means your selected stock or a portfolio has outperformed the market with same investment.

Observation are seen in CCP since 2000 are very interesting:

Observation No. 1: The shorter the holding period, the higher the quality premium but by only upgrading/holding their portfolios of quality companies. because in short horizon quality is not that important to generate good returns but it comes with greater volatility.

Observation No. 2: A high-quality portfolio with a very long holding period delivers the highest return with the lowest risk. Because here the quality of business is the most important factor. And longer the holding period higher the compounding rate and higher the return and lowers the risk associated with it.

It has been observed that quality company with patiently holding over the years and tracking the company can beat the returns of INDEX with less volatility.

Pulling It All Together

Essentially, what this book has highlighted is that: Investing for long periods of time in high-quality portfolios with a higher weightage to high-quality small-cap companies while ensuring that you don’t pay too much by way of fees and avoiding investment traps like real estate and gold should lead to significant and sustainable wealth creation.

If one is investing in financial assets it should be backed by some goals. Goals like financial stability, Ambition and for the security for other family members. All of these carry a financial cost and the cost rises with the inflation so you need to make sure returns are compounding more than inflation to create a healthy wealth. And if the goals are way to much expensive then you need to adjust your priority.

Warren Buffett’s famous two rules on investing are:

Rule No. 1 – Never lose money.

Rule No. 2 – Don’t forget rule number 1.

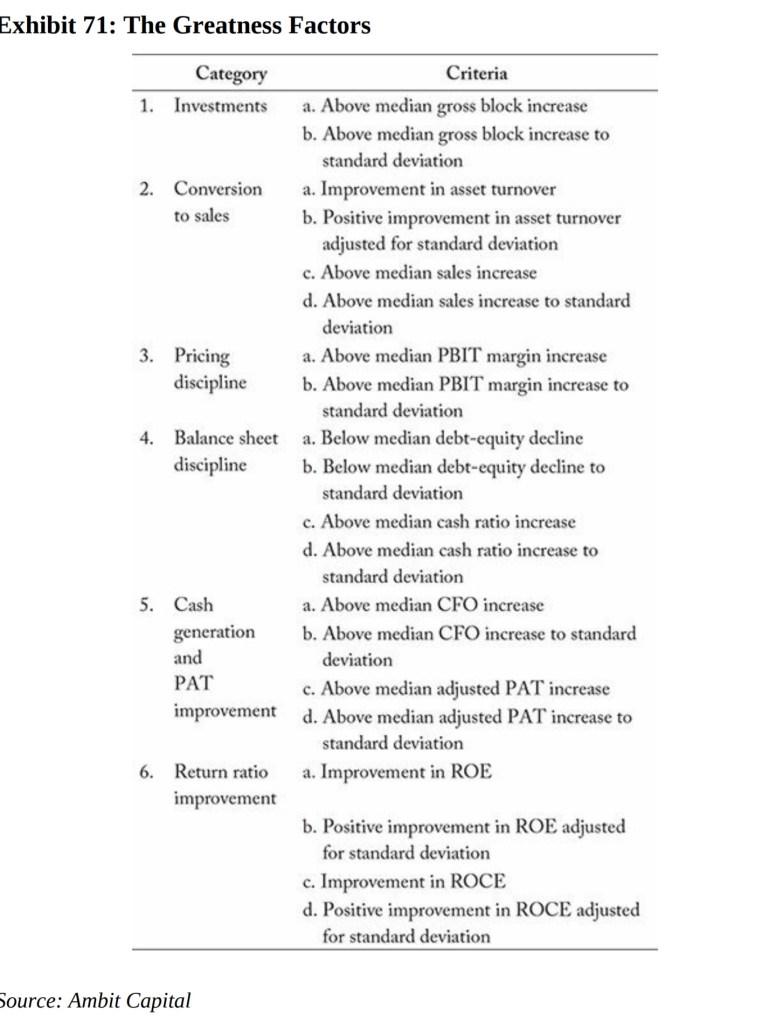

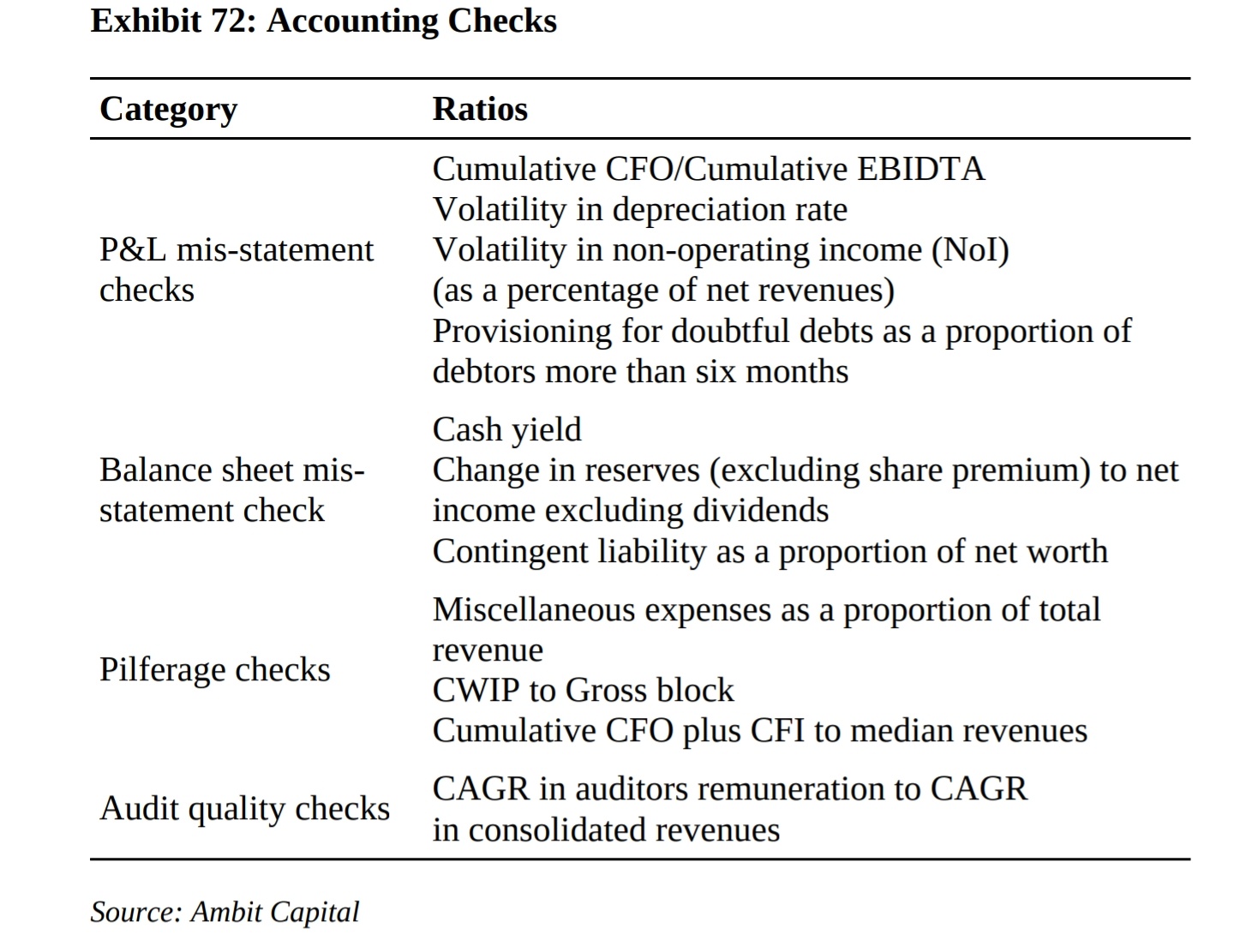

Good & Clean framework:

Good stocks are those that have created shareholders values. The goodness factor can be measured by a company doing multiple things as the following

Invest capital,

1)Turn investment into sales,

2)Turn sales into profit,

3)Turn profit into balance sheet strength,

4)Turn all of that into free cash flow,

5)Invest free cash flows again.

Clean stocks are the stocks that have a good corporate governance & all the necessary proper disclosures. The good helps generate the upside while not compromising on clean reduces the downside risk

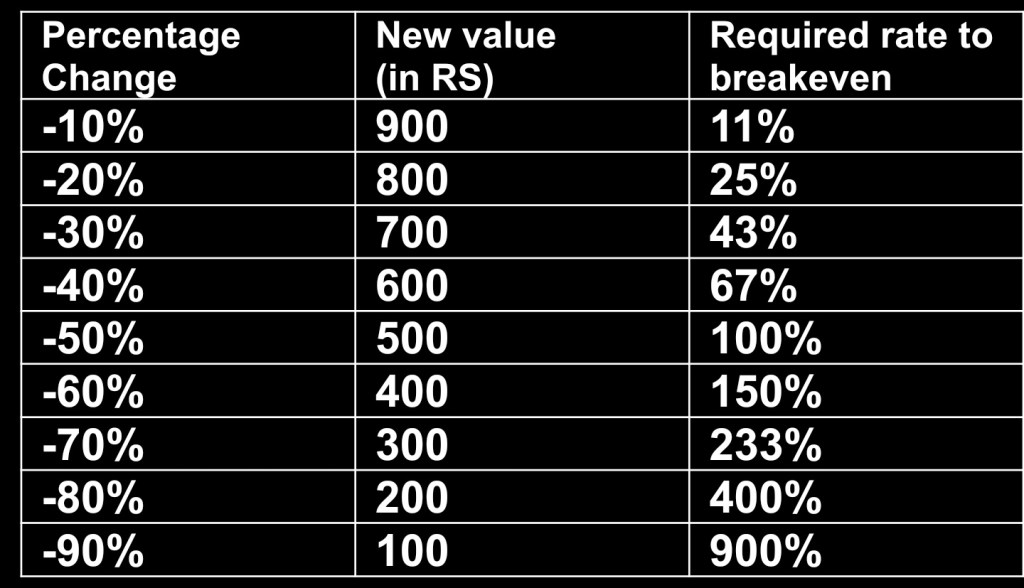

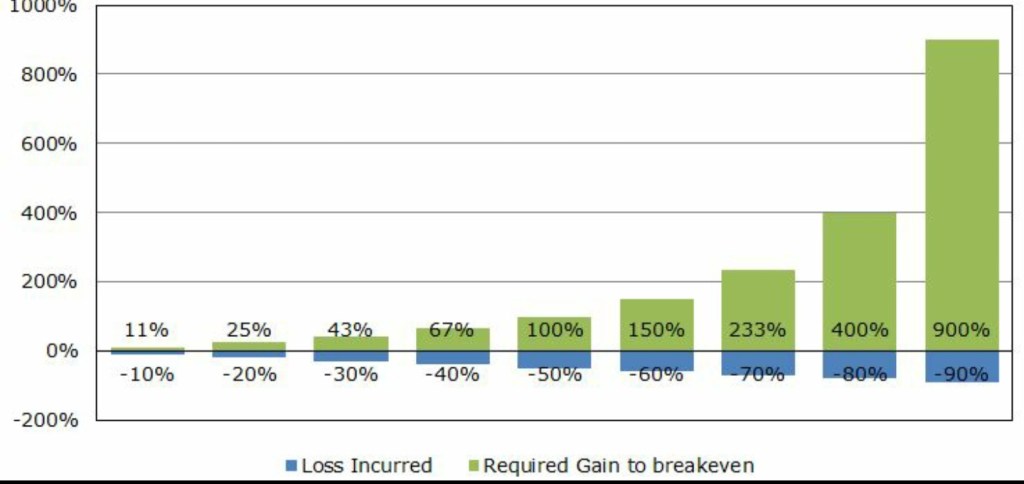

You need more upside to make up for the downside.

RS 1000 invested in all cases.

If your investment are 10% down so now your current value of your investment is now RS 900. To again reach to your initial investment you will invest RS 900 and 11% is required rate of return.

Lets do math,

PV= -1000 , I/Y = -10% , N=1, FV= 900. Now you are investing 900 so PV= -900 , FV= 1000 , N=1 , I/Y will come to 11%.

A highly credible debt fund is main factor while choosing right debt fund because as the credit quality is high the YTM is low for that fund. In Debt the safety of capital should not be compromised for a few basis points of extra returns. A debt mutual fund’s return is a function of: 1. Yield to Maturity (YTM), 2. Mark to Market (MTM), 3. Expense Ratio. In its most simplistic form, Debt Mutual Fund’s Return = YTM + MTM – Expenses.

The power of Equity

It was a mistake of Mr. Talwar for not investing in equity and holding it for long term. It can be described by a chart

Mr. Yogesh Talwar’s Case

He is an MBA & And has strong academic results. He was earning 2 lakh rupees per annum. he was had also invested in stock market is random stocks based on friends advice and selling it when price went up little bit. In those days stock market was just trading no concept of long term holding. And majority weight in Mr. Talwar portfolio was given to real estate. He had bought new luxury home in Noida and things went off the road in market crash of 2008. The random stocks which were bought by him were in deep negative returns and after that there was recession in real-estate too which wiped of his portfolio.

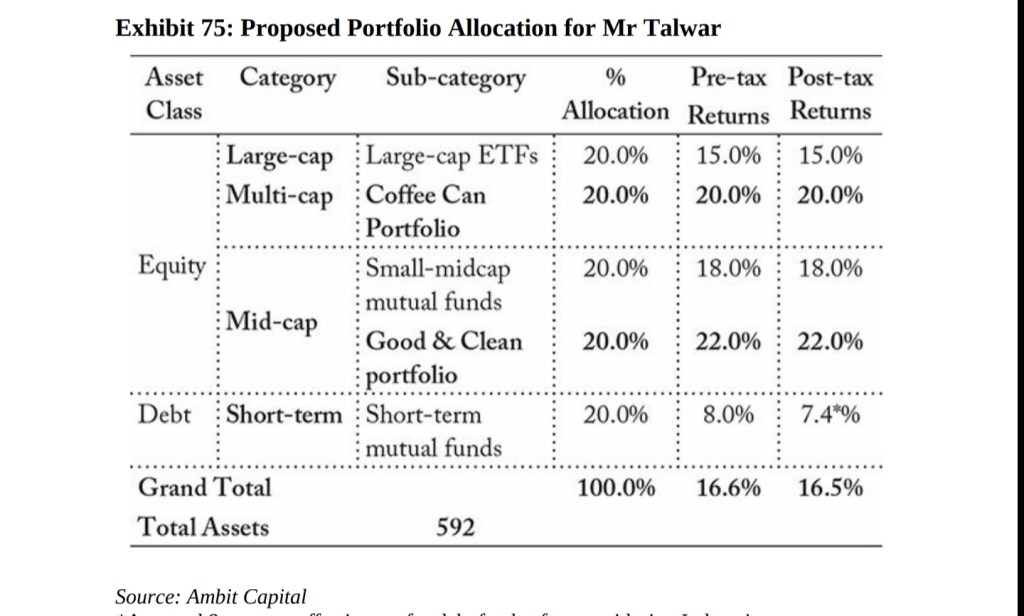

Then after that Mr. Talwar met Nikhil a financial advisor. He asked Mr. Talwar to write his investment. Then Nikhil calculated his net worth and he had earned just 4% over the last 27 years. Then he asked Mr. Talwar to write his financial needs and goals. The future expense were far way from his current return on investments. He approximately needed 21% return on his capital on post-tax basis. After all the discussion Nikhil made a new portfolio idea for him to try to achieve his goals.

Mr. Mukesh Sanghvi case

He was a joint owner with his brother & sister in textile business.

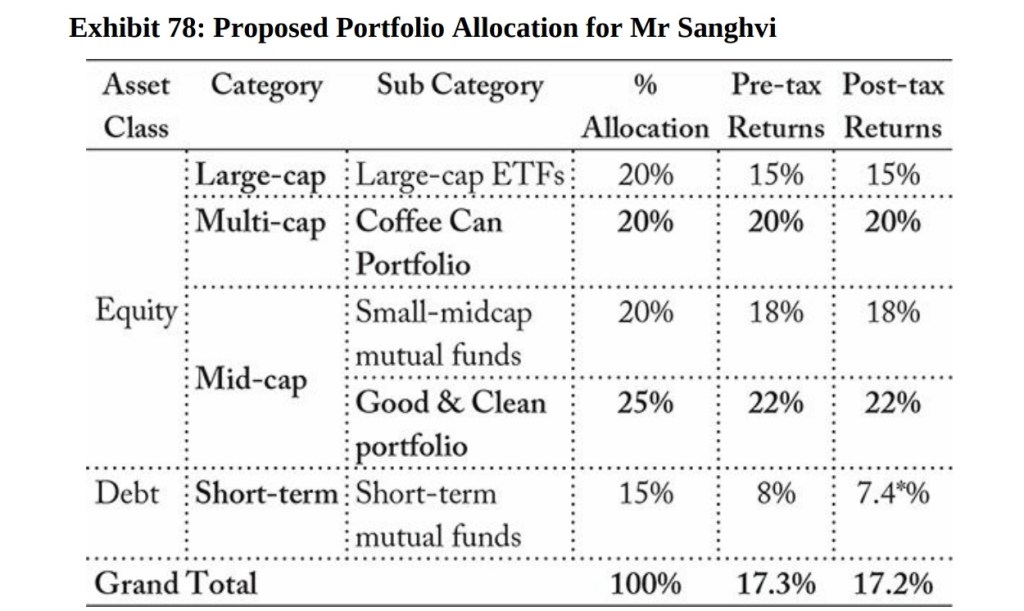

Mukesh Sanghvi was clear that at fifty-five years of age, he wanted to take it easy and live off his accumulated wealth. It was by no means meagre— according to a rough estimate he had Rs 25 crore spread across assets like residential and commercial properties, gold, FDs, stocks and a significant amount of cash he would receive from the liquidation. The annual expense of his family was 1.5-2 crore and he was a risk seeker in stock market. He was dealing in Future & Options. At the peak of 2008 he had about 150 crore worth of holdings and after the crash he was worth 25 crore. He was also giving loan in Hundi circuit at 25% per annum. Later after that Mr. Nikhil a financial adviser also came into his life and made him understand a good portfolio and their healthy returns. He had drawn down all the financial needs and goals of Mr. Sanghvi and his net-worth was around 451 crores. As the goals and expenses were too high Nikhil advised him to put more allocation in Equity to try to achieve those returns. Because Mr. Sanghvi is fully dependent on his portfolio to meet his expenses.

Breakup of his portfolio was 15% debt and 85% Equity in dividend paying stocks. And Debt investment in liquid funds to meet emergency needs.

How Punchy Can the P/E Multiple of a Great Company Be?

A large portion of investor’s uses P/E multiples for valuation. Most of them say buy at low P/E and sell at high P/E. The interesting thing about earnings is that it can be manipulated by management , and it does not provide re-investment of their earnings.

Lets take an example, Company X and Company Y has same earnings growth and same Revenue growth of 5%. Company X has P/E of 5 and PEG of 1 and Company Y has P/E of 7.5 and PEG of 1.5 . A normal investor would buy the company X and short the company Y based on P/E multiples. But the main thing is Company X needs to reinvest 50k to get 5% growth while Company Y need to re-invest just 25k to get the same growth. We can also state that marginal return on capital of Company Y has 20% while Company X has 10%. Higher P/E can also be justified by high earning growth in coming future.

Mean Reversion, this theory states that when there is no growth in a particular stock its P/E start to decline to Average Index P/E. So if a company is sustaining its ROCE to be at 35% and re-investment rate of its earnings to be 50% the P/E multiple will be higher due to higher growth and will fall to Index P/E when there is no growth left.

Lets say if a company is growth at 17.5% and the SENSEX CAGR is 13% for 25 years

Total return for shareholder after 25 years would be 25*(1.175)25 = 1408.92.

Discounting this return with opportunity cost of capital = 1408.92 / (1.13)25 = 66.36.

This company’s P/E would be trading at approx 66.

And majority of good business are trading at high P/E and outperforming the market. So it means healthy returns can be earned while entering with P/E.

Should Investors Sell Coffee Can Stocks When Markets Are Richly Valued?

CCP enjoys it competitive advantage over its competitors. Buying the CCP when Nifty P/E < 14x and selling when Nifty P/E > 20x has not outperformed ‘buy and hold’ strategy. So trying to time the market using this multiples has always been proved wrong as the good business have strong fundamental and always looks expensive.

How Coffee Can Portfolios Outperform during Market Stress?

Only when the tide goes out do you discover who’s been swimming naked. This quote of Warren Buffet has always been proved correct. When there is market crash majority of the companies erode the value to investor because they have not understood the company fundamental and its risk. And all the great business with sound fundamental stays positive.

When the market falls CCP tends to fall, but when market starts to show recovery CCP start to show recovery two times faster than market.

All the key learnings from this is that one should invest in a quality company he understands thorough research is necessary and apart from that one should clear all the noise and buy & hold long term and track the price and let the compounding magic show its effect on your wealth. And if investors does not understand a business or company he should passively invest in INDEX funds or Coffee can Portfolio to grow their wealth.