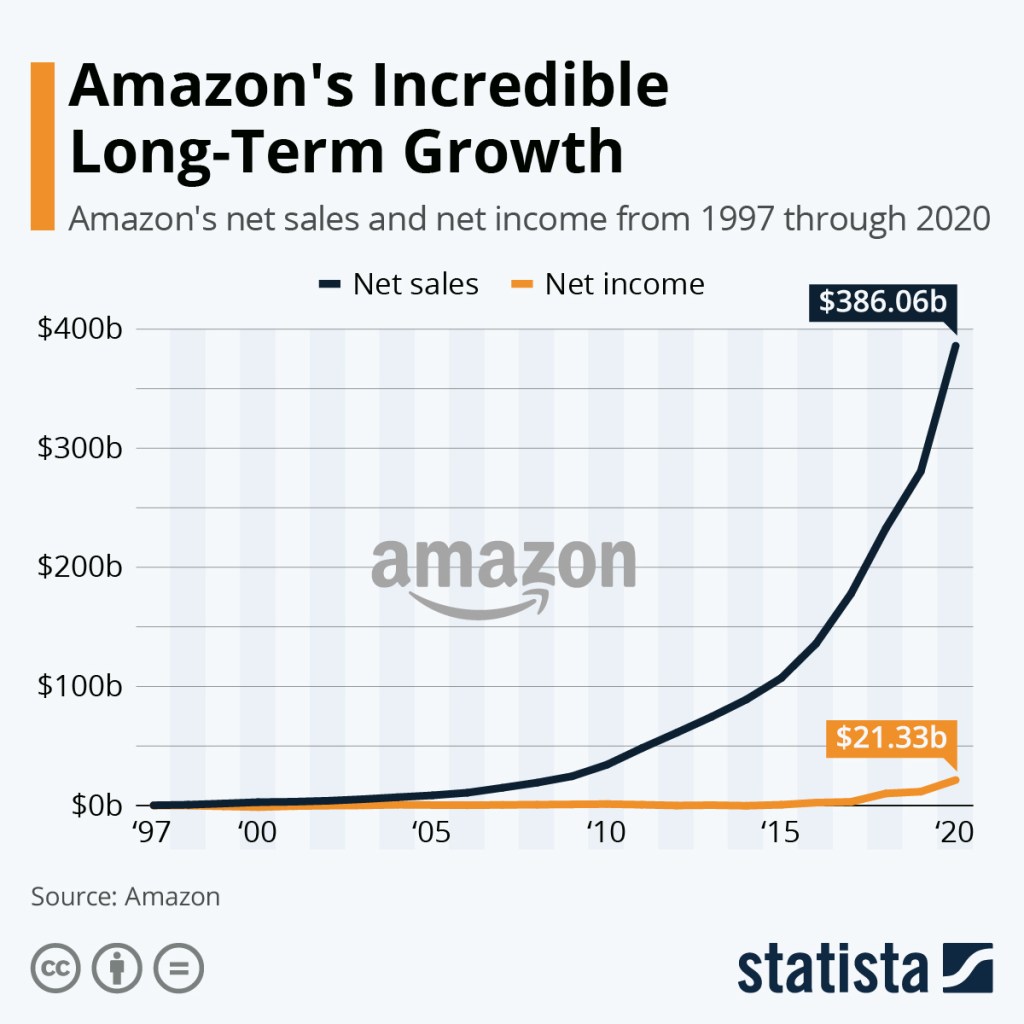

Amazon.com, Inc. is an American multinational technology company. It is one of the Big Five companies in the U.S. information technology industry, along with Google, Apple, Microsoft, and Facebook normally called as part of FAANG. But in the past 20 years Amazon has shown powerful Revenue but with just a minimal profits. It can be easily seen with Charts.

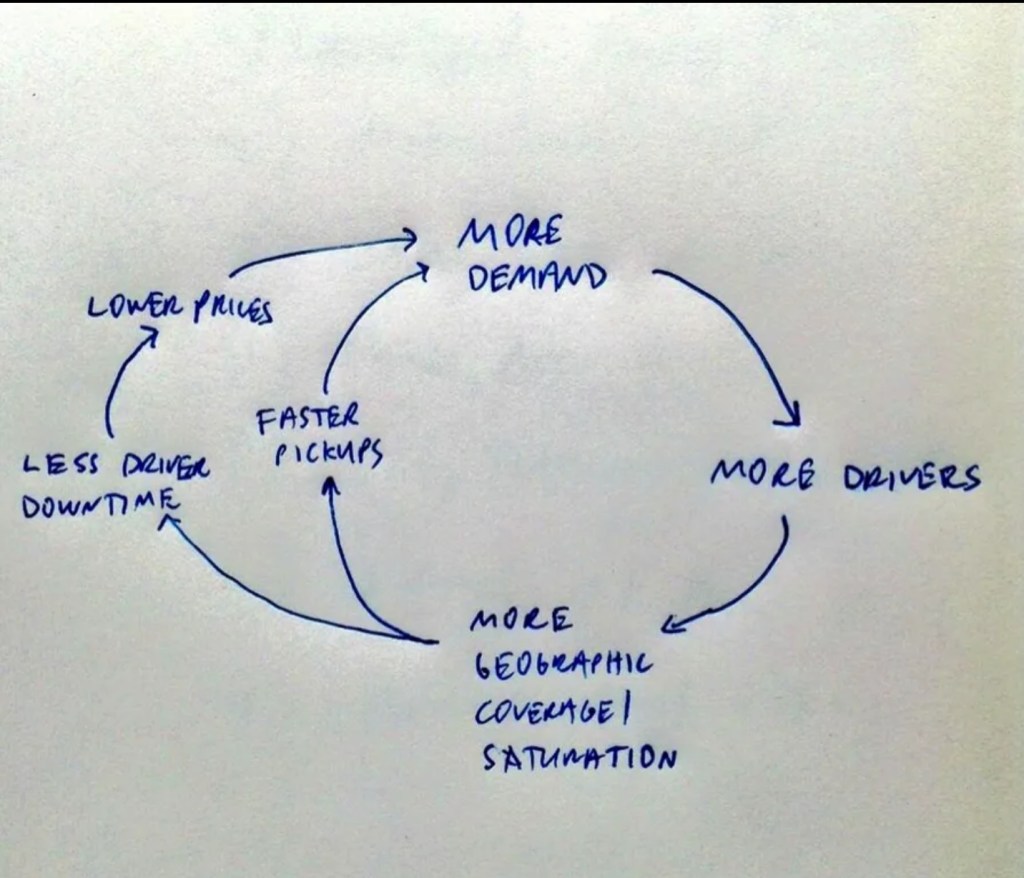

Does that mean it’s a failing business? No the small profits margins are one of the secrets for Amazon success. Amazon is intentionally showing low profit margins because large portions of profit is going in re-investment in the company to make it more profitable for future. But does that means everytime re-investments in our company can be profitable? No not everytime examples like Uber and WeWork tried to copy this strategy of amazon but they haven’t proved to be right.

Amazon discloses revenue in three segments – Media, Electronics & General Merchandise Amazon divides its business into three segments: North America, International, and AWS. The first two of these segments, North America and International, refer to geographical breakdowns of Amazon’s retail business. They generate revenue from retail sales in North America and the rest of the world, as well as from subscriptions and export sales for those areas. Retail can further be broken down into online stores, comprising the bulk of sales, and physical stores. Media, Electronics & General Merchandise (‘EGM’) and ‘Other’, which is mostly AWS. Aside from retail, the other primary source of revenue for North America is subscriptions, including Amazon Prime, which offers unlimited free shipping, and unlimited streaming of movies, TV shows, and more.

Amazon Web Services (AWS), launched in 2006, provides services to businesses, government agencies and academic institutions to store information and deliver content. Amazon says AWS provides an “infrastructure platform in the cloud,” for a variety of “solutions” such as hosting applications and websites, providing enterprise IT, and content delivery. Amazon controls about a third of the global cloud market. AWS’s biggest competitors are Microsoft Corp.’s (MSFT) Azure and Alphabet Inc.’s (GOOGL) Google Cloud.

It seems pretty likely that these businesses, selling very different products bought with different bargaining positions to different people with different shipping costs, have different margin potential.

This are not the only segments Amazon is in there are other business segment too. You can see revenue by broad categories of the business, but most of its costs are clubed together in one giant section on the income statement. It doesn’t present a full P&L by each business line to outside world so it becomes very hard to understand each business line individual. So, say, shoes in Germany, electronics in France or makeup in the USA are all different teams. Each of these businesses, incidentally, sets its own prices. And all the business segments are at different stages some at maturity some at growing some are not profitable. Books are a good example. There’s a widespread perception that Amazon sells books at a loss, but the average sales price actually seems to be very close to physical retailers.

The gross margin has improved mainly due to the rising proportion of service sales (which include third-party sales) in overall sales, as these sales have lower cost of goods sold due as they are trading goods. However, this trend has negatively impacted costs as cost as a percent of sales is greater for third-party sales than Amazon’s owned-inventory retail sales. This is because, payment processing and costs are generally dependent on gross purchase price, but, the company recognizes only its share of revenue from products sold by third-parties as service sales. this means that the total value of goods that pass though Amazon with Amazon taking a percentage is perhaps double the revenue that Amazon actually reports.The revenue line is not really telling you what’s going on, and this is also one reason why gross margin is pretty misleading too. This means, in passing, that for close to half of the units sold on Amazon.com, Amazon does not set the price, it just takes a margin.

The image below comes straight from Amazon – originally it was a napkin sketch by Jeff Bezos. Note that there’s no arrow pointing outwards labelled ‘take profits.’ This is a closed loop.

In any case, profits as reported in the net income line are a pretty bad way to try to understand a business like this – actual cash flow is better. As the saying goes, profit is opinion but cash is a fact, and Amazon itself talks about cash flow, not net income. And thanks to how Amazon’s payment cycle works, it usually gets money for selling an item long before it has to pay for that item. For example, it takes Walmart on average nearly three days to receive payment for goods after it paid its suppliers, while Amazon on average receives payment about 18 days before it paid its suppliers, according to the latest available cash conversion cycle data. It has even more money coming in before the money for last quarter’s bills is due and that’s the reason FCF are rising more than profits.

Amazon focuses very much on free cash flow (FCF) and it has grown at 31.18% CAGR of 15 years From $529 in 2005 to $31,020 in 2020(data from http://www.macrotrends.net) . And from that majority part goes towards CAPEX and the remaining part is Operating cash flow. Amazon began spending far more on capex for every dollar that comes in the door, and there’s no sign of the rate of increase slowing down. Its free cash flow is higher than most of the revenue you’re seeing in many tech companies,” managing director at RBC Capital Markets Mark Mahaney told Recode. “You could take Snap, Twitter, and Pinterest and combine their revenue and that would be less than the free cash flow Amazon is generating.”

Amazon has boundless ambition. It wants to eat global retail. If it were purely a software business, its cost of investment would be lower, but the amount of capital required to grow a business that has to ship millions of packages to customers all over the world quickly is something only a some of the companies in the world could even afford.

The company’s strengths of integrated digital platforms in supply chain management and master till last line in delivery. Early this year, Amazon purchased eleven Boeing 767 passenger jets that are being converted to cargo planes, bringing its total fleet to 85 by the end of 2022; it is the first time Amazon is making an purchase as before it used to take on lease cargo planes. Between April and August 2020 , Amazon Air flights increased 27%. Amazon has been testing drone delivery and offers a program called Amazon Delivery Service Partners allowing people to start their own package delivery business using Amazon’s superior logistics knowledge and technology capabilities. By owning and controlling the major aspects of the supply chain, Amazon becomes less reliant on third-party suppliers like FedEx, UPS and USPS, allowing it to shorten its delivery time from click to door. In early 2020, Amazon reduced click to door time from 3.4 to 2.2 days (the industry average is 5.1 days). Amazon Prime’s has insanely-fast shipping. The most common guess as to how Amazon flips the switch is that it will wait until it is the last retailer standing and then raise prices across the board.

Perhaps most important things is real cash profits not paper profits. Amazon’s access to cash enables it to do everything from paying its employees, suppliers, and shareholders to investing in its future. And while investing for its future lowers its profits in current years it also lowers its taxes by creating less taxable income.

If you would have invested $100 in Amazon.com IPO in 1997 @ $18 per share you would have 5 shares. 2:1 split in 1998, 3:1 split in 1999 and again 2:1 split in end of 1999. Now the total number of shares would be 60. And the current market price in 2021 is $3,362 that means 60*$3362 = $210,720. And lets convert in INR , $1 in 1997 was worth ₹37 and now the current rate is ₹75 for $1. So the total investment would be ₹3,700 and the return would be ₹1.58 crores. Total return would be 427,035.1% return.

Not all companies have an IPO that can guarantee you riches. Amazon has defied the odds and has arguably been the most successful public company in modern history.