Do you know market size? How big it is or is there any space left there to grow? It can be understood by Total addressable market (TAM). TAM refers to the total market demand for a product or service. It is the maximum amount of revenue a business can possibly generate by selling their product or service in a specific market. No matter what kind of business you have- start-up, small-medium enterprise, or large enterprise. It is the most powerful metric to understand your potential market size and major players. Even a monopoly cannot capture total addressable market because it would be difficult for them to convince them to buy their product. So most of the business measure how many customer they can reach through their marketing and sales channel so that they can estimate their actual target market. However TAM can be used to estimate the potential growth in specific market.

Even multi-billion-dollar corporations don’t sell to “everyone”.

Lets take an Example,

Consider an Hair salon in Mumbai City with population of 12.5 million. Majority are female customer that is approx. 46% of total population sums to 5.75 million out of which only the age group between 20-30 years are the most users. Approx. 40% are females with age between 20-30 years And out of 5.75 million only 2% of female users come in middle or upper middle class category because this salon provides high end services. And average haircut price for high end salon is ₹250.

Total Females between 20-30 years are 40% of 5.75 million = 2.3 million

Total middle or upper middle class category in females is 2% of 2.3 million = 46k

46000*250 = ₹11.5 million

This means High end salon service TAM is ₹11.5 million and only 46k female customers in Mumbai city. And in Mumbai city there are approx. 30-35 high end salon service because of this the TAM will be shared with competitors.

There are three ways to calculate your business’ total addressable market:

1) Top down, this approach uses industry data, market reports, and research studies to identify the TAM. In these type of data you can even find subsections and you can also get estimate of total market of that subsections. But the niche element of business is not considered here. For example if a company has provided their store retail sales TAM but after a certain time their TAM can change due to online applicability/utility and other factors. But on the other side due to online applicability can also increase their TAM for example E-learning during COVID-19.

2) Bottom-up, this approach uses past data like sales and price. This the most effective approach for computing TAM. Lets say you are selling a product to various retail shops. So first you need to calculate your annual turnover i.e Sales or annual Revenue of ₹100million. And lets say there are in total 200 retail shops in your city.

Total addressable market = Total number of customers in a market x Average annual revenue of a customer in the market

= 200*100 million

=₹2 Billion

3) Value Theory, this approach basically means how much value your customer gets through your product/service. And how much premium they are willing to pay for it. Value theory is used to calculate TAM when a company is introducing new products into the market or cross-selling certain products to existing customers. Lets take an example of SWIGGY- a food delivery service. User are opting to ordered their food online by just adding food to cart and paying online or COD and getting them hand delivered to their address. Since users are willing to avoid all the other ways and they are willing to premium service charges can be use to value their pricing. This approach often also comes when companies are considering expanding their core product and cross-selling into existing customers as part of a long term strategy.

With a good knowledge of TAM, start-ups and enterprises can achieve their sales goals and can predict realistic path towards success. This can increase confidence among investors. TAM allows your sales and marketing team to identify your ideal buyer, prioritize the right market, and to generate revenue faster. You can also predict the amount of Revenue you can generate within your market. Share of market is the size of your actual customer base of your addressable market that you can capture.

Author Archives: Pritul Jain

Arbitrageurs tap into G-Sec yield anomaly

Arbitrage is the process of buying and selling an asset in two different exchanges or locations. This creates an opportunity for an arbitrageurs to take advantage of price discrepancy. Hence the arbitrageur buys a asset in one market and sells the same asset in another market at a higher price, thereby enabling investors to profit. This make risk free profit.

Anomaly is the way to generate abnormal profits from active investing. RBI’s buying program has led to the price mismatch in similar maturity bonds where yields for 3 similar bonds changed. This led to the price mismatch in bonds and the spread between these bonds were as high as 49 basis points.

Off the run bonds – Bonds which are issued before the recently issued bonds.

On the run bonds – Bonds that are latest issued bonds.

Off the run bonds usually are traded less after a new latest bond is issued by RBI. Hence the liquidity in off the run bonds also decreases and due to lack of trading and liquidity the price doesnt change often hence there comes the opportunity for arbitrageur to exploit this difference between the illiquid off the run bond and the current on the run bond.

Archegos Ripples Through Banks’ Lucrative Hedge Fund Units

US regulators are considering tougher disclosure requirements for investment firms in response to this year’s implosion of Archegos Capital Management. Securities and Exchange Commission (SEC) officials are exploring how to increase transparency for the types of derivative bets that sank Archegos, the family office of billionaire trader Bill Hwang. SEC signaled the banks to make trading disclosure from Hedge fund as top priority. And by this it will re-assess the relations between them.

While Morgan Stanley and Goldman Sachs acted fast, Nomura and Credit Suisse weren’t so quick. Nomura Holdings and Credit Suisse Group, the two lenders hit hardest, have started to curb financing in the business with hedge funds and family offices. European regulators are looking at risks banks are taking when lending to such clients, while in the US, authorities started a preliminary probe into the debacle.

The prime brokers lends the money and execute their trade and it can be harmful for them even though they have securities as a collateral as seen in the Archegos. Credit Suisse has been the worst-hit so far, taking a $4.7 billion writedown in the first quarter.

The lender, one of the biggest prime brokers among European banks, is now cutting the arms to lends such heavy leverage without optimizing risk in next months. It has already been calling clients to change margin requirements in swap agreements — the derivatives Hwang used for his bets — so they match the more restrictive terms of other prime-brokerage contracts. Specifically, the bank is shifting from static margining to dynamic margining, which may force clients to post more collateral and could reduce the profitability of some trades. Credit Suisse has been forced to take a number of measures. After dumping a significant amount of stock at a loss, the executive board has suspended bonuses related to fiscal 2020. The bank had been under pressure already. Just one month ago, it suffered losses from the collapse of Greensill Capital, a British supply chain finance firm

Nomura, which is facing an estimated $2 billion from the Archegos, followed suit, with restrictions including tightening leverage for some clients who were previously granted exceptions to margin financing limits. This restriction of margin limits can lead to scaling back of the business. Hwang’s family office built positions in at least nine stocks taking more and more leverage on these stocks only through various banks at a time. And the banks couldn’t see they were piling leverage from other banks too. His portfolio was estimate around $100 billion.

While the checks by the European Central Bank on lenders such as Deutsche Bank AG and BNP Paribas SA are standard practice after such a disruptive event, they underscore regulators’ concern, even as most euro-region banks skirted big losses.

Investors can learn a lesson from all this about the high risks of trading on margin. While using margin can make good times for your stocks great for your portfolio, in bad times it is more of losses than you might have gained. And in decline stage margin calls like the ones that crushed Archegos can bring your entire portfolio down.

Heavy use of margin and leverage is one way to turn $20 billion into $200 billion in years — and to turn $20 billion into $0 in just a few days.

Wary Hedge Funds cut offshore Rupee bets.

Rising crude oil prices, foreign fund outflows and spiking Covid-19 cases weighed on the domestic currency.

Hegde Funds and overseas institution were comfortable to take long position on rupee till they saw robust growth in India amid covid-19 second wave. But the rupee slipped to 75 against one dollar and RBI net sold $600 million in local exchange traded future, spot markets and in non-deliverable forward. Because hedge funds and overseas institution were believed to take strong bets on rupee against dollar but the expectation did not work and instead of that they bought heavy long position in dollar causing higher demand in dollar in NCDs. This large scale position caused slip in rupee. While this types of trades has always impacted rupee-dollar but this time market reaction were too quick which was led by RBI to let banks trade in NCDs in GIFT City International Financial Centre. And in India due to public holidays there was pressure on rupee when currency markets were closed. With the US yields rising global investors are now interested in Investing Dollar-backed market. Since the starting of currency exchange and till now rupee has lost nearly 2100-2200%. From ₹3.3/$ in 1947 to ₹75/$

CitiBank To Exit Retail Banking In India:

In India, Citi Bank has only 35 retail branches and employs about 4,000 people in its consumer banking business. In contrast, one of India’s largest domestic banks, State Bank of India, has about 24,000 branches. In Asia as a whole, at the end of 2020, Citigroup had 224 retail branches and $123.9 billion in deposits.

Citi’s CEO, Jane Fraser, said in a call on the bank’s first quarter earning that it is announcing strategic actions in its Global Consumer Banking – to divert capital and investment where it has the most growth potential. Its Global Consumer Banking presence in Asia and EMEA would be focused only on four locations – Singapore, UAE, Hong Kong and London.

The bank will exit 13 international consumer banking markets across Asia and parts of Europe, which includes India and China, Australia, Bahrain, Indonesia, Korea, Malaysia, Philippines, Poland, Russia, Taiwan, Thailand and Vietnam. No immediate service disruptions expected as it will continue to serve all its existing customers. The bank said that its institutional client group will continue to serve customers in these 13 countries. Citibank India has now put on sale its retail banking business that includes advances totalling Rs 66,507 crore and deposits worth Rs 1,57,869 crore.

Citibank India, which began operations here in 1902. It popularised the concept of credit cards and ATMs in India in the ’80s. Data from the Reserve Bank of India show that Citi has nearly 26,45,784 credit card consumers in India, with a nearly 4.29% share of the market measured in the number of cards outstanding as of February 2021. However the market leader in this segment, HDFC Bank, who in the same month has nearly nearly 1,51,97,803 customers and a share of nearly 24.65%. HDFC Bank is temporarily prohibited from issuing credit cards by the RBI as a penalty of experiencing frequent online outages. Total credit cards outstanding as on February month end are 6,16,47,183.

Citibank will not be the first foreign bank to scale down its operations in India. In 2013, Ratnakar Bank Limited (RBL Bank) bought three businesses – mortgages, credit cards, and business banking – from the Royal Bank of Scotland for an undisclosed sum. In the same year, IndusInd Bank purchased Deutsche Bank’s credit card business – almost 2 lakh customers for ₹224 crores.

Western banks HSBC and RBS have also trimmed their foreign retail banking operations in recent years due to costs and low growth.

The big question here is who will buy the bank’s retail business. It is tough to find a new buyer with proper licensing with RBI during this period. There will be different valuation for there different business segments. So if some bank plans to buy their mortgage business they can and if one wants to buy credit card business can go that segment individual.

Park 10-20% of your portfolio in international MFs.

International Funds are those funds which invest in equity and debt of foreign countries like US, Europe, China, etc. Investors who wants to invest in foreign companies can invest through this channel because directly investing in foreign companies for retail investor is complex. This funds provide low correlation with Indian markets this can help to diversify their portfolio and reduce their risk in time like covid-19. There are other various reason to invest in those funds such as Provides access to high growth companies not listed in India. Provides strong hedge against rupee depreciation (rupee depreciation increases returns from international funds). In the last one year Investor are investing in those funds in large. The number of folios in those funds rose to 700k from 200k in April 2020. And the AUM rose to RS 12,408cr from RS 3,282cr.

Some Fund names are as follows:

Edelweiss Greater China Equities Off-shore Fund, Fund of Fund scheme investing in the Greater China Fund of JP Morgan Fund. Equity fund primarily investing in companies domiciled or carrying out their main business activities in the Greater China Region – China, Hong Kong and Taiwan. Takes high conviction approach while investing in just 50 stocks out of 785 stocks in MSCI Golden Dragon Index. This fund gave 16.92% CAGR for 10 years having AUM of RS 1272 cr

Kotak Global Emerging Market Fund , Invests in the small cap companies of the Asian and/or Pacific region. This fund has given 12.92% for 5 years CAGR with expense ratio of 1.67 while having fund size of just RS 127cr.

ICICI Prudential US Bluechip Equity Fund

DSP US Flexible Equity Fund

There are other various Mutual Funds which offers mix equities of Indian companies as well as foreign companies like Parag Parikh Flexicap Fund.

Taxation policy in International MFs have Short term capital gains on redeeming units before 3 years of investment are taxed @ 15%. Long term capital gains on redeeming units after 3 years of investments are taxed @ 10% (along with cess and surpluses, if applicable) with indexation benefits.

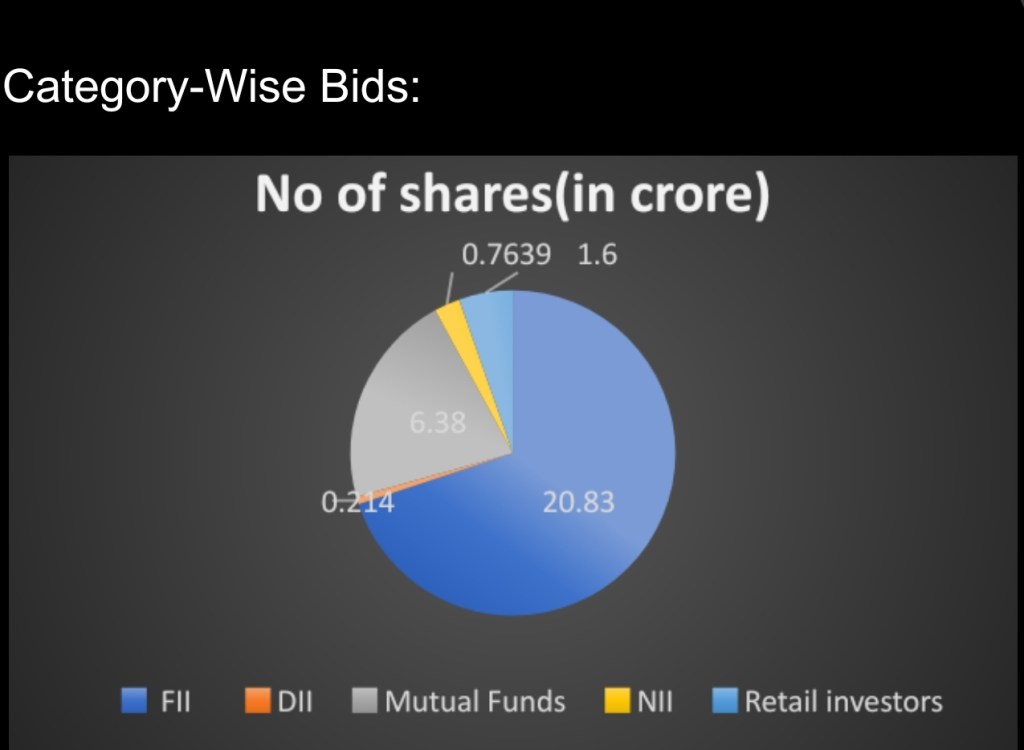

Vedanta’s Open Offer Gets 57.5% Bids:

The second failure of Vedanta’s Open offer in the last 6 months. The first offer was in October 2020 where the promoter was only able to get on 125.47 cr bid against the required 134 cr shares. And the second offer was in march which was to acquire 17% in its Indian subsidiary and was offered at revised price of ₹235 a piece from ₹160 a piece. This second offer got bid by just 57.5% in which only 37.42 cr shares were tendered against 65.1 cr shares if this offer gets accepted by them then it will raise their stake by 10.01% totalling to 65.18%.

The stock has been seeing a huge bull rally lately. Vedanta, which is a major metal company in the sector, is into the business of aluminium, zinc, copper, steel, iron ore and overall, it has very well diversified its business in the metal space.

Besides, Vedanta also holds around 65% stake in Hindustan Zinc, which is a cash-rich company. Hind Zinc is known for giving huge dividends to the investors and experts predict that there is going to be a huge upside in this metal stock. Moreover, in the crude oil, Cairn Oil & Gas vertical of Vedanta can also see an improvement in the earnings. Despite the huge rally in benchmark indices and broader markets, Vedanta shares are down from its all-time high of ₹495 apiece. Life Insurance Corporation, one of the biggest investors in the equity market, had also valued this company’s stock at around ₹320 per share a 267% premium over the floor price of ₹87.52. If the company accepts this 57.5% bid offer company cannot launch new open offer in within one year. Investors should not tender their shares because company was ready to buyback their shares at ₹87 and₹150 and now their offer is ₹235 a piece one should wait even when LIC quoted price of ₹320 a piece. As per the rules of SEBI a promoter can buy 5% of its company shares from public market if the current stake in its company is more than 25% and less than 75%. So they have bought 5% when they were holding 50.14%.

Promoter of the Indian listed company will have to acquire atleast 50%f the public shareholding in their firm or 90% in total equity capital which ever is higher to delist successfully.

Flipkart to Acquire Cleartrip for $40 Million

Cleartrip was Established in 2006 by Hrush Bhatt, Matthew Spacie and Stuart Crighton, it was positioned as a hotels and air travel booking marketplace. It has been competing with bigger rivals, such as MakeMyTrip and Goibibo, for the past decade

Cleartrip’s investors namely Concur Technologies, DAG Ventures and Gund Investment. Some of its early backers—Kleiner Perkins, Sherpalo Ventures and DFJ—have exited the company. Cleartrip last raised funds in 2016 and has in all picked up about $70 million in investor capital. Sources said it was valued at around $300 million then.

With the pandemic bringing about a change in consumer behaviour and an increase in online adoption, Flipkart has been focusing on enhancing consumer experiences through several investments. The flipkart backed by walmart has been on a massive acquisition lately. And now flipkart is in talk with cleartrip to acquire it for $40 million and thus making strategic allocation in travel industry. Flipkart is investing and it assumes to take down every travel industry in competition. Cleartrip deal is an distress sale due to covid. Cleartrip earns more than 80% of its revenue from airline bookings Several airline companies have once again started demanding financial assistance package from the central government due to second wave of covid.

Ponzi Scheme Mastermind dies in US prison at the age 82.

Bernie Madoff, a well-known Wall Street investment advisor, became world-famous for operating possibly the largest Ponzi scheme in history. Madoff served as non-executive chairman of the NASDAQ exchange in 1990.

Madoff’s Ponzi scheme was operated through the wealth management portion of his business. It was a classic – and simple – Ponzi scheme. Madoff attracted investors by promising them extraordinarily high returns on their investments. However, when investors handed over the money, Madoff just deposited it into his personal bank account at Chase Manhattan Bank. He paid “returns” to earlier investors using the money obtained from later investors. Things fell apart in 2008 when a large number of investors wanted to cash out their investments due to stock market crash.

When investigators for the FBI and the SEC finally uncovered the massive fraud in 2008, losses by Madoff’s investors were estimated at $64.8 billion over the course of nearly 20 years and sentenced to 150 years in prison. Madoff’s thousands of victims included individuals, charities, pension funds and hedge funds. The United States government ended up offering to pay out more than $700 million to defrauded Madoff investors, but that amount paled in comparison to the billions upon billions of dollars that investors had been scammed out of. However, it is true that some of Madoff’s earliest investors did manage to recover their full investment amount plus a hefty profit.

Delisted Chemplast Sanmar files papers for RS 3500cr IPO

Chennai-based Sanmar Group deals in chemicals, shipping and engineering. The company is the largest domestic paste PVC manufacturer. The group has revenues of more than $1 billion. Chemplast Sanmar – fifty years old and the flagship company of The Sanmar Group – is a major manufacturer of PVC resins, Caustic Soda, Chlorochemicals, Refrigerant gas and Industrial Salt. The manufacturing facilities are located at Mettur, Berigai, Panruti and Vedaranyam in Tamil Nadu and Karaikal in the Union Territory of Puducherry. The Chlorochemicals division of Chemplast, a result of backward integration by the Group, manufactures a wide range of products using a highly integrated manufacturing process. The salt needed for chlorine manufacture is supplied by Chemplast’s salt fields at Vedaranyam. The power-intensive electrolysis process of manufacturing chlorine is served by Chemplast’s own power plant. All this makes Chemplast one of the most integrated chemical plants in the country with a closed manufacturing loop. Located in Berigai, Tamil Nadu, 60 km from Bangalore, Sanmar Speciality Chemicals (SSC) manufactures a range of multi-customer products from Cyanation, Hydrogenation and high efficiency fractionation technologies. Its constant development of environment-friendly production processes has reduced the consumption of valuable natural resources.

The company, which was delisted about a decade ago, is now coming back to the stock market and will likely file the draft Red herring Prospectus (DRHP) next one week. It is seeking a valuation of ₹10,000 crore.. Nearly one and a half years ago, Fairfax India Holdings Corporation had completed an equity infusion into the Sanmar Chemicals Group, taking its equity holding in the group to about 43%. The company has raised NCDs in December 2019 which had let Debt To Equity of 1.49 in FY20 as compared to 0.18 in March 2019. The proceeds of the IPO will be used largely to reduce the company and group level debt. For FY20, the latest numbers available, the company reported a revenue of ₹1,259.31 crore, marginally higher than the revenue of ₹1,252.69 crore reported in the previous fiscal, according to a 31 July note by Brickworks Ratings. Profit fell to ₹98.74 crore in fiscal 2019-20, from ₹187.21 crore. Demand for PVC has seen robust growth 10-13% led by government new rule for irrigation sector and affordable housing segment.