About the Authors:

Saurabh Mukherjea

is the Founder and Chief Investment Officer of Marcellus Investment Managers. Marcellus Investment Managers was incorporated in August 2018 and the firm’s application to conduct Portfolio Management Services was approved by SEBI in October 2018 and provides portfolio management service.

Rakshit Ranjan, CFA

Rakshit has a B.Tech from IIT (Delhi) and is a CFA charter holder. He launched Ambit’s Coffee Can PMS in Mar’17 and managed it till Dec’18. Under his management, Ambit’s Coffee Can PMS was one of India’s top performing equity products during 2018.

Pranab Uniyal

is the head (products and advisory) at Ambit Capital. He has a BTech degree in chemical engineering from IIT, Madras, and a postgraduate diploma in management from IIM, Calcutta.

The culture of Stock Market in India:

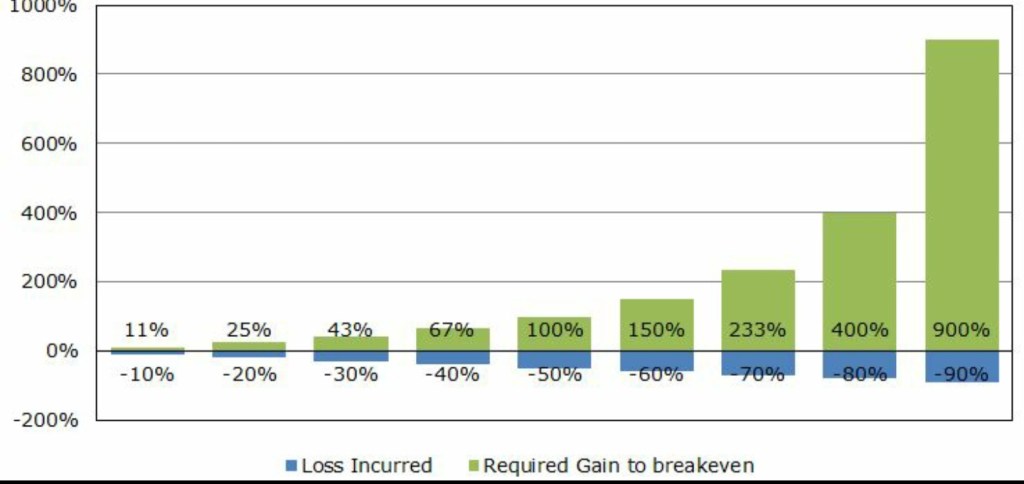

Millions of young Indians have started stock trading during the pandemic, raising hopes that the appetite for equities in the world’s second-most-populated nation is finally growing. Historically gold has given low returns, I do not think modern Indians are investing much in gold and real estate with sums upto to 88%. Things have changed over the last years. Moreover, after demonetisation and better tax administration, widespread diversion of black money to gold and real estate has come down significantly. All the brokerage house have seen tremendous growth in opening new Demat account. But after that also only 5% of Indian population invest in financial instruments. For India’s 1.36 billion people, only about 3.7 per cent invest in equities, compared with about 12.7 per cent in China, according to stock depository data on the number of investment accounts In the US about 55 per cent of the population owns stocks either individually or through a mutual fund.

Common mistakes investor does that leads to wealth erosion:

Not having specific plan/objective to invest lacks to specify the duration of investment.

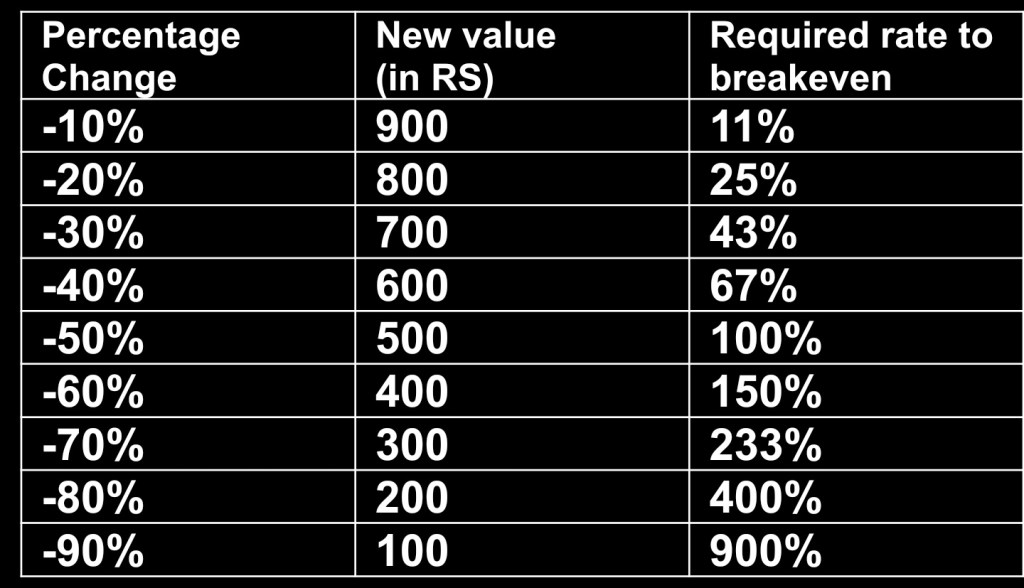

Trading too much to make small gains that leads to short term capital gain tax and brokerage is also high in these activities.

Risk averse invest in FDs and Risk seeker invest more in risky assets that lacks diversification.

Timing the market is the wrong activity one does. Investor think they can catch the stock at low and sell at high.

The effect of Inflation should be adjusted in the potential gain in any investment.

Coffee Can Investing:

Churning your portfolio, i.e., buying and then selling stocks frequently is one of the easiest ways to produce sub-optimal returns in the stock market. Appreciating the destructive power of churn, most thoughtful investors have tried different ways to reduce churn and thus hold stocks for much longer periods of time. regard has been the “Coffee Can Portfolio” construct created by Rob Kirby of Capital.

There are various misconception in investing like more return has to come with more risk. But not in all the asset class for example in equity selecting a efficient company after analysis and understanding various risk related to it and then investing and holding it for years comes with greater return than risk. Another misconception is that “buy and forget” this strategy works in a rare case the perfect statement would be “buy and hold” and track where the price of that stock is going.

It was interesting to know that Sir Issac newton the great mathematician and breaking all the new discoveries could not understand the market. Being smart does not mean smart investor. And being patient is a quality required in investing.

Coffee can portfolio focus on strong characteristics:

Revenue earned from core business not from other source of income. And y-o-y growth rate.

Top players in their respective industries. Basically a moat

Trustworthy management and their sensible asset allocation strategies.

Company that has both tangible and intangible asset. Because company with tangible asset can be copied not with intangible asset. Intangible asset makes the company different from others.

Focus on Company which has lower Debt as compare to Equity.

In Berkshire Hathaway’s 2007 letter to shareholders, Warren Buffett explains that the kind of companies he likes to invest in are ‘companies that have

a) a business we understand

b) favorable long-term economics

c) able and trustworthy management

d) a sensible price tag. A truly great business must have an enduring “moat” that protects excellent returns on invested capital.

Composite of Coffee can portfolio

Coffee Can Investing is an old concept of the West. Where people put valuable possessions in a coffee can and hide them. After many years when they open it, they usually end up with huge profits. Coffee Can investing style can be replicated by buying the best company with a good track record & holding them for years. There are various filters use to identify quality stocks.

Below are the 3 main points required to be satisfied before investing:

Segregate companies into Small Cap (Market Cap of 100 Crores- 5000 Crores), Mid-Cap (5000 Crores- 20000 Crores) & Large-Cap (20000 Crores & above).

Sales should have grown by 10% in the last decade on an average basis. (Growth prospects)

ROCE of 15% should also be generated. (Returns to lenders of capital). Adding a risk free rate to Equity risk premium along with credit rating sums up to 15%

ROE of 15% as it shows the ability to generate higher profits for shareholders. on a given capital base.

Loan growth of 15% as the GDP of India on average for past 10 years is 13.8% so loan growth of 15% shows banks creditability

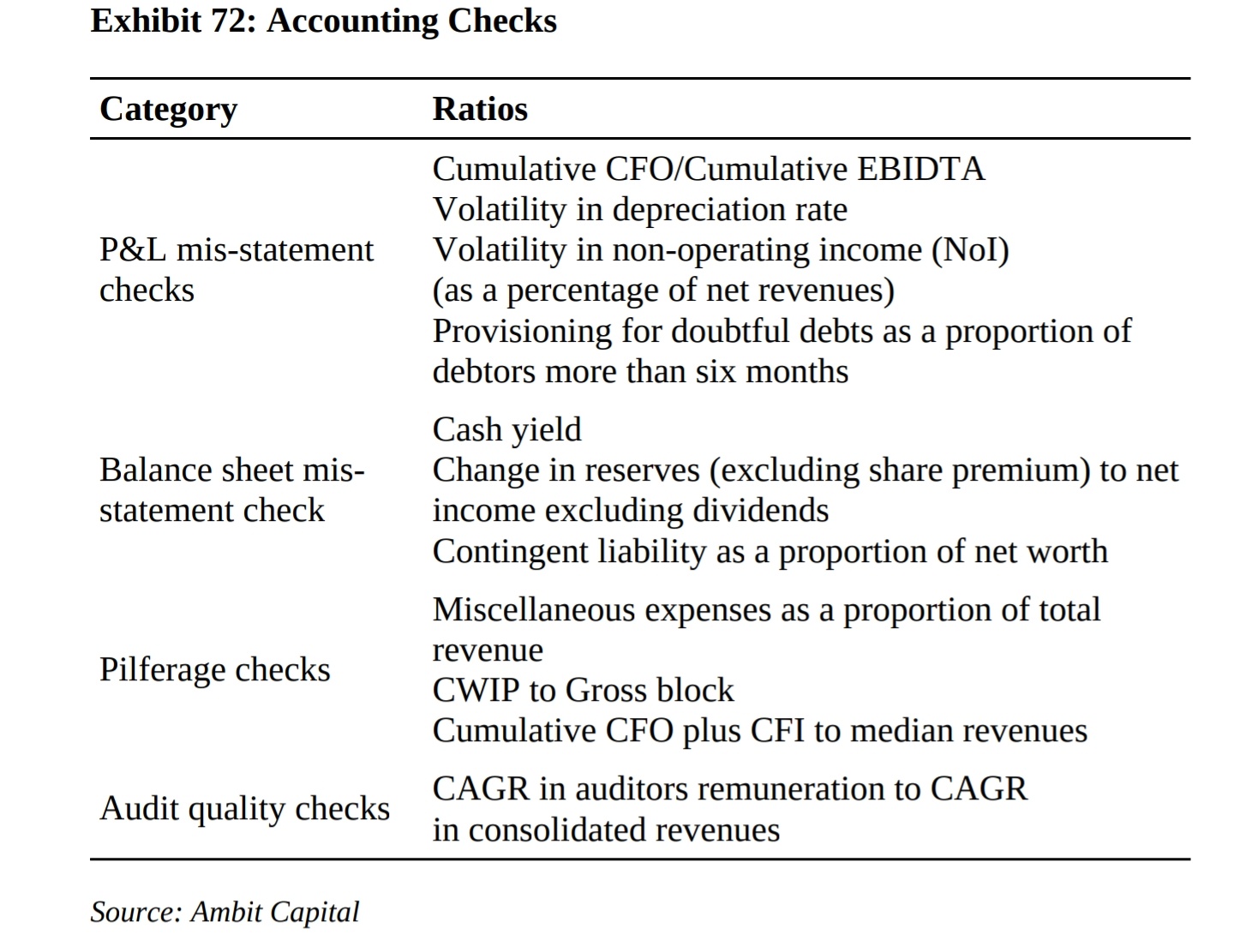

Why use a ROCE filter of 15 per cent? We use 15 per cent as a minimum because we believe that is the minimum return required to beat the cost of capital. Adding the risk-free rate (8 per cent in India) to the equity risk premium of 6.5 to 7 per cent gives a cost of capital broadly in that range. The equity risk premium, in turn, is calculated as 4 per cent (the long-term US equity risk premium) plus 2.5 per cent to account for India’s credit rating (BBB-as per S&P).

Why use a revenue growth filter of 10 per cent every year? India’s nominal GDP growth rate has averaged 13.8 per cent over the past ten years. Nominal GDP growth is different from real GDP growth. Nominal GDP growth is not adjusted for inflation. In simple terms, it is (GDP) evaluated at current market prices. A credible firm operating in India should, therefore, be able to deliver sales growth of at least that much every year.

The importance of Coffee Can Portfolio.

Having a quality portfolio is extremely necessary to create a healthy wealth . The following two points have been observed when the markets fall.

CCPs tend to fall less when the markets fall.

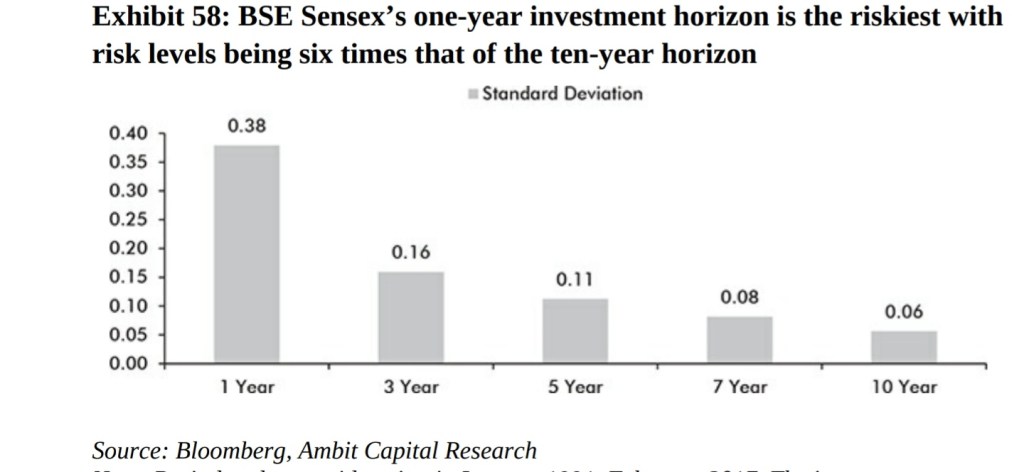

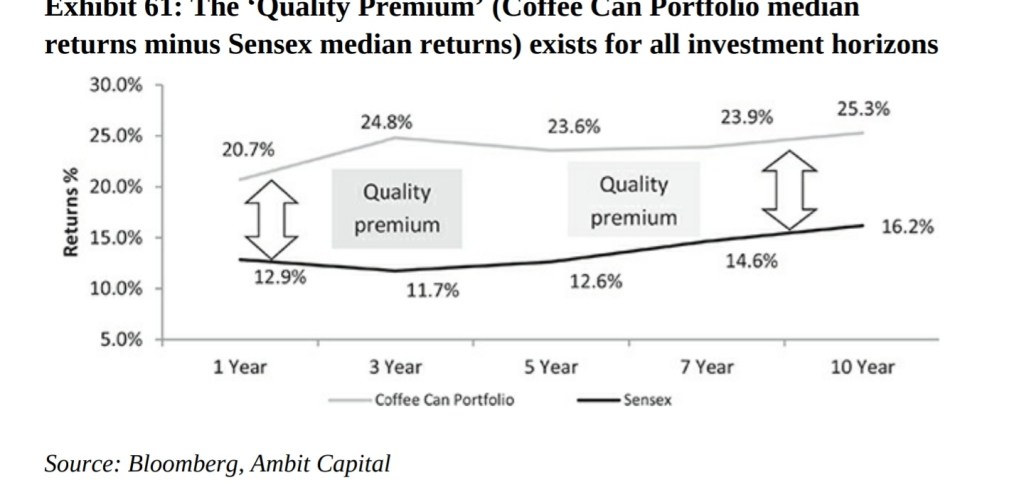

The recovery is quick & stronger when the markets start rising again. In simple terms, it means that historical data suggests the Coffee Can Portfolio offers more than a 95 per cent probability of generating a positive return as long as investors hold the portfolio for at least three years. If held for at least five years, there is more than 95 per cent probability of generating a return greater than 9 per cent.

Advantages of Coffee Can portfolio

Investors do not need to track their portfolio once the initial hard work is done.

It minimalizes the expense cost. We do not need to pay the costs like management fees, transaction fees, the opportunity cost of tracking the portfolio, etc.

The volatility is ignored as you do not need to track the portfolio.

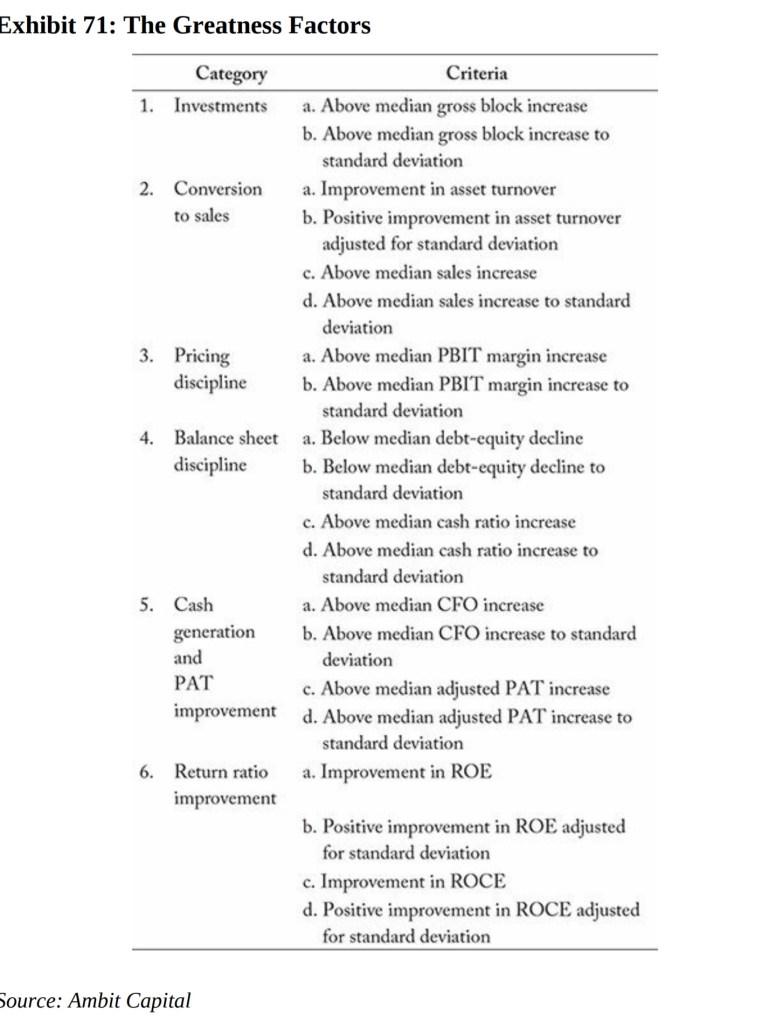

Why choose revenue growth and ROCE as the financial metrics to measure ‘greatness’?

Charlie Munger, vice chairman of Berkshire Hathaway, stated in his lecture at the University of Southern California in 1994, ‘Over the long term, it’s hard for a stock to earn a much better return than the business which underlies it earns.’ Munger meant that the returns generated by any company’s share price in the long term cannot be significantly more than the return on capital employed generated by the company in its day-to-day business.

He explained this with an example, ‘If the business earns 6 per cent on capital over forty years and you hold it for those forty years, you’re not going to make much different than a six percent return—even if you originally buy it at a huge discount. Conversely, if a business earns 18 per cent on capital over twenty or thirty years, even if you pay an expensive looking price, you’ll end up with one hell of a result.’

Three categories of businesses based on Return on Capital:

High earnings businesses with low capital requirements: For example Candy store, these businesses can’t, for any extended period, reinvest a large portion of their earnings internally at high rates of return. Candies business can grow with incremental income. Two drivers for minimizing capital requirement first is that business is a cash business and second is the difference between production distribution process is minimal so no need of holding inventory.

Businesses that require capital to grow and generate decent ROCE: A fast growing business needs huge amount of capital to grow. Capital requirement in fixed asset and some tied in working capital to increase revenues. Such business provides decent ROCE.

Businesses that require capital but generate low Returns on Capital: This type of business is Telecom sector which require huge amount of capital to grow. In this business sector customer base is more important where CFI is more than CFO.

Page Industries: A case study of ‘greatness’

Page Industries Ltd. is engaged in the manufacturing distribution and marketing of Innerwear Athleisure Sleepwear and Swimwear for men women and kids. The company is the exclusive licensee of Jockey International Inc. (USA) for manufacture distribution and marketing of the JOCKEY brand in India Sri Lanka Bangladesh Nepal UAE Oman and Qatar. Page Industries is also the exclusive licensee of Speedo International Ltd. for the manufacture marketing and distribution of the Speedo brand in India consisting of swimwear apparel water shorts equipment’s and footwear. JOCKEY is the company’s flagship brand and a market leader in the innerwear category. The company has established the premium segment in the innerwear category in India through brand Jockey.

As per Warren Buffett’s categorization of businesses, Page Industries is a

perfect example of a business that requires capital to grow and generates

decent ROCE. Over the past ten years, Page has, on an average, reinvested around 50 per cent of its operating cash flows back into the core business via fixed asset investments to expand its manufacturing capacity. Despite this, the firm has either maintained or improved its ROCE over time, implying that it has successfully and consistently generated healthy ROCE on the reinvested capital as well.

How did the Page Industry sustained over the years in just one business segment? With various competitors in various segments. One would think making and selling innerwear isn’t a big thing. A innerwear should always be more comfortable than clothes we wear over. Jockey has provided best quality of comfort over the years and still maintains it. Innerwear also has to be strong and durable. As if all this wasn’t enough, difference in physiques, weather-related factors and consumer preferences of comfort in India are not entirely similar to those abroad. Consequently, the product design, fit and fabric composition of an undergarment stock keeping unit (SKU) has to be indigenized in order to be successful in India. If a consumer accepts a particular style and brand, it is highly likely that she/he will stick to it. Therefore, consistency of product quality and design.

The ‘feel good’ factor of consumer purchase in innerwear is driven by a combination of fresh introduction of designs across sub-segments of innerwear and fresh introduction of colours within existing styles. Very few clothing brands have got all these factors right in India. The firm has been very focused on deepening its moats for a very long time. Genomal family (the promoters of Page) have focused on the undergarment business and have no intention of diverting to anything else.

Page has maintained

a) measured capacity expansion with no more than 1500 labourers in a single factory, which reduces the risk of unionization;

b) focus on hiring women

c) lifestyle support provided to the workforce. This workforce is regularly

trained to ensure high efficiency levels. These aspects have been supported by use of operational efficiencies and R&D to help it produce a high-quality product.

Between March 2007-2017 this stock has given CAGR of 45%.

What about Valuation?

The started period valuations has little or no impact in long run. Some might say that buying cheap stocks is not a very clever idea. But surely, selling expensive stocks when they become expensive is a good idea.’

Coffee can investing is more oriented towards:

More B2C (Business to Consumer) than B2B (Business to Business)

sectors.

More structural rather than cyclical plays.

Avoiding companies that borrow lots of money to grow.

Prefer companies with intangible strategic assets.

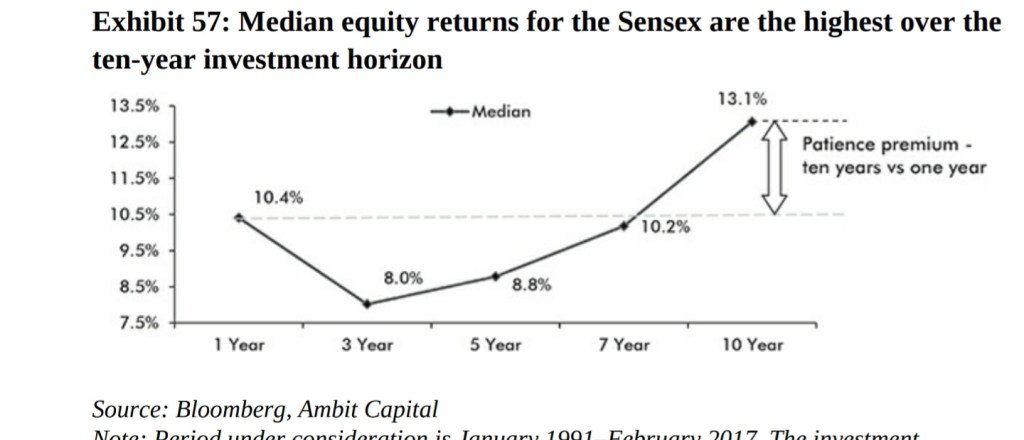

Power of compounding: Holding a portfolio of stock for ten years or more allows the power of compounding to play out its magic. Because the effect of compounding is not seen in early stage of investing it is seen in later stage of your investment horizon that should be minimum of 10 years.

Complex Investments (ULIPs).

ULIPs (Unit Linked Insurance Plans) are hybrid instruments having a dual purpose of insuring towards life cover & invest the remaining money in financial instruments. The financial advisors lure more investor into this because they get more commission. The true picture of this plan.

Most of the investors have no clue about the terms of these Plans.

The premiums paid by the customers go heavily towards brokerage commissions (40-60% of the first-year premium).

Most of the investors were not informed that they were required to invest every year to avoid lapsing of their policies. The terms were so strict that even a single lapse by investor gave companies the right to confiscate the customer’s fund. This led to a loss of 1.5 lakh crores for the retail investors falling for these products.

Index Funds v/s ETFs And Active Managed Funds

Both are passively managed investment vehicles designed to mimic the performance of other assets class but ETFs are actively managed investment in small percentage. Index funds have more expense ratio than ETFs. ETFs, or exchange traded funds, which fully replicate a benchmark. For example, a Nifty ETF is a fund that invests in all the fifty Nifty companies in the same proportion as they are in the index. This ensures that the value of the fund moves exactly like Nifty. In an actively managed fund, a fund manager manages the money using his judgement and discretion and thus charges a fee for using his brains. At the other end, passively managed funds have no input from a human manager

Many Expenses investor pays knowingly or unknowingly,

Transaction Fee is also called a brokerage fee. For example your broker charges 0.5% on buying and selling that means if you buy and sell for 5 times your total transaction fee is 5% of your portfolio return.

Annual Fee is also called as AUM asset under management charged by various PMS Additionally, there may be a performance fee as well where the fund manager is entitled to a share of the profit that he is able to generate for investors.

Hidden Fee this type of fee is not easily understood by many investors such as hidden fee in ULIPs.

Fund Expenses compound too: The investor pays certain expenses for this fund management (Mutual Funds/PMS)t as well as other operational expenses. Lets compare two funds. Fund A has 2.5% charges and B has 0.1% charges and both have same Gross return of 15%. 1 Lakh Invested in each fund for 40 years. Fund B has reached Rs 2.6 crore and Fund A is at Rs 1.1 crore. The difference is compounding of expenses which is lost by Fund A. Most Mutual funds have expense ratio of 2.5% and ETFs have 0.1%. Most investor focus on gross return and not the expenses.

American investor have started taking out their money from active funds and have parked their money in passive funds. The 80% in passive and 20% is active is changed from 20% in passive and 80% in active funds.

Entry of SEBI, direct scheme were launched by SEBI in 2007. Direct scheme involves just the investor and fund manager. So there are no intermediary so no brokerage cost or any other cost just the minimal percentage to be paid to fund house. Fees in direct funds are half than Regular fund. In 2013 SEBI made it compulsory for all the mutual funds to have direct option for investors. In response, SEBI, through AMFI the mutual fund industry’s trade body introduced the ‘best practice guidelines’ in 2015. The guidelines stated that the upfront commission that a fund pays to a distributor cannot be more than 1 per cent.

A twenty-year-old who invests Rs 1 lakh at the start of his career will get Rs 1.6 crore at the age of sixty from his investment in the direct fund (which has no involvement with any distributor). In contrast, he will only get Rs 1.1 crore in the regular scheme. As much as Rs 50 lakh, or a staggering 31 per cent of his returns, are taken away by the distributor from whom he bought the fund forty years ago.(assuming direct funds charges 0.1% and regular plan charges 2.5%)

Finally, SEBI has created a new regulatory rule which forces intermediaries to declare whether they are a fund distributor, or an ‘adviser’ whose fees will be paid by the ultimate investor and whose interests are fully aligned with the investor. The combination of hiring a good adviser and then purchasing sensibly priced funds directly from the fund houses gives investors a higher chance of generating healthy returns while keeping risk under control.

How Indians fell in and out of love with stocks:

It was between 1990 and 1995 that retail investors in India fell in love with stock market investing for the first time. In this period BSE Sensex was quadrupling in less than twenty months—from 1000 points in July 1990 it crossed 4000 points1 in March 1992, supported by the liberalization of economic policies. Investors’ love for the stock market was such that the number of retail investment folios that existed in 1995 was more than the number today. The effect of this investor interest was also reflected in IPOs—during 1992– 96, around 4000 companies went public (implying around four IPOs per day). All the investors were investing their black money because lack of regularity. In that period company used to give 6-8 pages of IPO prospectus to investor versus 500 pages of today. Many promoter defaulted many companies came out be a dump company but after the SEBI came into picture and changed the format of holding stocks in Dematerialized form. After that phase people started investing in Real estate and gold in the year 2013. There was a boom market for real estate prices in Mumbai were same as New York city. However, there has been a trend reversal in investors’ choice of asset classes since 2015, the year in which the NDA launched its multi-pronged attack on black money.

The NDA’s success in dramatically reducing the flow of black money seems to have been centred around:

Directly transfer of subsidy and benefit from Indian Government to Beneficiary. Government disburse 4% of GDP or 6 Lakh crore to beneficiary account. This new policy were implemented by our Prime minister of India Narendra Modi. In past years half of the subsidy were stolen by politicians.

Demonetization: On 8 November 2016, the government demonetized 86% of the country’s total currency in circulation. This resulted in the forced deposit of over Rs 15 lakh crore (US$ 230bn or 10 per cent of the GDP) into the banking system, of which a sizeable proportion is likely to have been black money.

The Real Estate Regulatory Act (RERA): Over the years builders used to trade in black money by cheating government in stamp duty and registration. There was no transparency and accountability of funds. Without the permission rules they used to Start building on plots with bribing the government. RERA act came into effect by 1st May 2017 it has led transparency and sound business. From now on 70% of the funds collected from buyers are kept in separate bank account to meet the building material cost this has stopped diverting the funds into another type of land acquisitions.

Introduction of GST: The introduction of GST came in 2017 those who are not paying taxes find it difficult to get new customers. Those who are not paying taxes are not getting benefit of Input tax credits which helps in reducing tax burdens.

Small cap companies has outperformed large cap stocks. The outperformance over large cap was 5.9% between 1998-2004 while in US it has been 4.6%. BSE Small-cap includes 768 stocks with a median market cap of Rs 1600 crore.) Over the past eight years (2009 to 2017), the BSE small-cap index has beaten the BSE 100 by 4.6 per cent per annum.

Why great small cap companies has outperformed the large cap?

Small cap grow faster when the liquidity is more in market so small company can easily get loans from banks while having low creditability. Another reason can be when large cap companies are going through disruption there is where competitive advantage lies. The probability if a great company becoming sector laggard is 25% while staying again at the top for the next decade is just 15%. On the other hand, owners and managers of small companies are hungry to grow, hungry to achieve greatness and all the perks which come with it. This helps smaller companies consistently grow profits faster than larger companies.

Most of the brokerage house ignores small cap and does not publish any reports and this small cap stocks are not in media coverage. Small cap stocks are more riskier than large cap stocks. Small cap stocks lacks in managerial staff as most of the small cap promoter holders and their company director are family members only.

Portfolio managers have a problem with the approach as they need to perform better month-on-month & year-on-year. This restricts them to implement buy & hold strategy & save transactional costs. Approaching investing in coffee can be very difficult for them as they have to put in a lot of effort in the start and ripping benefits would take years. Also, convincing investors to stay invested for 10 years itself is a difficult task.